There is something many people do that loses them business and friends and even relationship partners. It becomes a bad habit, and the odd thing about it is that it is usually done with the best of intentions.

I'm referring to the fact that many people over-promise and under-deliver. This one single facet of doing business or relationships destroys people's reputations and credibility very quickly. It should be the other way around, which is why I suggest to anyone doing business of any kind that they give their customers and clients more than their money's worth.

It's understandable the when someone is insecure or desperate for business or wanting to be liked, he or she will over-promise. There is a strong desire in most of us to be liked or loved by others, and one way not to do it is to promise someone the moon and deliver a tiny meteorite instead. I notice that this is a big problem in Panama, where the locals always agree with whatever you are asking for, even if they know there is no way they can deliver it the way you want it, or when they promise to have it ready. But it's certainly true all over the world, and the U.S. is a place where you find it strongly evident in two industries, printing and contracting.

Very rarely is a contracting job finished when the contractor said it would be, and very rarely is a printing job delivered on time. I remember a printer in New Jersey who did a booming business because he had come up with a solution to this problem. If he knew with some certainty that your job would be ready on Tuesday, he'd promise it for Thursday. Everyone else in the printing business in those days did the opposite, promised it for Tuesday when they knew it was unlikely it would be ready before Thursday.

Of course, that printer was ahead of his time. Now many businesses have gotten in the cheap habit of promising something at the lowest common denominator of performance, so that they always exceed the promise.The New Jersey printer didn't just make a promise he knew he could keep, but he put just as much effort in doing the jobs in less time than other printers. His intention was to set a reasonable time for delivery, and then work hard to beat it. What you see a lot of today is businesses just lying so as to look good. So they eliminate one practice that hurt credibility and just substitute another.

Looking over your own life, would you say you usually are in the under-promise and over-deliver category, or the other way around?

If the latter, you might explore being honest and just saying you have no idea when it will be ready, but you will do your best to make it happen as soon as possible.

We all love getting more than we asked for, or getting it sooner than expected. Now living in a country definitely not known for high standards of customer service, particularly in restaurants, I sometimes yearn for a place where someone over-promises and under-delivers as opposed to one where people often don't promise at all, just nod and smile a lot, and hardly ever deliver what was requested by the time it was asked for.

In Panama, it does help to have the patience of a Zen monk, and that's just the way it is, by golly.

Jerry

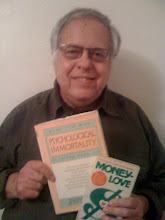

To see an example of over-delivering, check out my free prosperity blog, with information many consider more valuable than the expensive prosperity programs offered all over the Internet. Not to mention the 39 page free Moneylove Manifesto you can download there.

http://MoneyloveBlog.com

Monday, May 27, 2013

Saturday, May 18, 2013

THE SCANDAL BEHIND THE NON-SCANDAL

So the IRS is under fire for delaying action for tax exempt status requests from conservative groups, with Speaker of the House John Boehner claiming he doesn't just want resignations but wants to know "Who is going to jail?"

Now it does seem certain IRS employees did focus unfairly on right wing groups asking for tax exempt status, a list that grew exponentially after the Citizens United 2010 Supreme Court decision. But the whole issue is as phony as the Soviet military capacity was during the height of the cold war. Because the IRS shouldn't even be considering tax exempt status for any of these political organizations, liberal or conservative, under the original 501 (c) 4 law as written by Congress. That law states emphatically

that such tax exempt status be limited to:

“civic leagues or organizations not organized for profit but operated exclusively for the promotion of social welfare.”

MSNBC's Lawrence O'Donnell has been discussing the real scandal all week, and hardly anyone else seems to have noticed it, including Nancy Pelosi who today called for a new law to limit tax exempt status to non-political social welfare organizations. That law is already in place, it is the original wording of that section of the Tax Code.

Proving that the IRS has been guilty of doing stupid things for many years, back in 1959 some idiot there changed the wording to read "primarily" instead of "exclusively" for social welfare groups. This opened up the law to its fuzzy current status, where many IRS bureaucrats don't really know how to evaluate these tax exempt requests. No new law is needed, it only requires that the law as originally enacted be enforced. This would eliminate from tax exempt status any and all groups engaged in political activity at any and all times.

The lack of knowledge about this egregious change of wording by the IRS proves two big things. First, that a single word can mean a world of difference. Second, how really stupid most politicians are and how ill-informed, as we hear all the rants about how the IRS delayed consideration of tax exempt status for groups that never should have been considered for such status at all. And every such group, liberal or conservative, which now has this tax exempt status should have it revoked. It's the law and the U.S. is supposed to be a country of laws.

'Nuff said.

Jerry

Check out my prosperity blog at:

http://MoneyloveBlog.com

Now it does seem certain IRS employees did focus unfairly on right wing groups asking for tax exempt status, a list that grew exponentially after the Citizens United 2010 Supreme Court decision. But the whole issue is as phony as the Soviet military capacity was during the height of the cold war. Because the IRS shouldn't even be considering tax exempt status for any of these political organizations, liberal or conservative, under the original 501 (c) 4 law as written by Congress. That law states emphatically

that such tax exempt status be limited to:

“civic leagues or organizations not organized for profit but operated exclusively for the promotion of social welfare.”

MSNBC's Lawrence O'Donnell has been discussing the real scandal all week, and hardly anyone else seems to have noticed it, including Nancy Pelosi who today called for a new law to limit tax exempt status to non-political social welfare organizations. That law is already in place, it is the original wording of that section of the Tax Code.

Proving that the IRS has been guilty of doing stupid things for many years, back in 1959 some idiot there changed the wording to read "primarily" instead of "exclusively" for social welfare groups. This opened up the law to its fuzzy current status, where many IRS bureaucrats don't really know how to evaluate these tax exempt requests. No new law is needed, it only requires that the law as originally enacted be enforced. This would eliminate from tax exempt status any and all groups engaged in political activity at any and all times.

The lack of knowledge about this egregious change of wording by the IRS proves two big things. First, that a single word can mean a world of difference. Second, how really stupid most politicians are and how ill-informed, as we hear all the rants about how the IRS delayed consideration of tax exempt status for groups that never should have been considered for such status at all. And every such group, liberal or conservative, which now has this tax exempt status should have it revoked. It's the law and the U.S. is supposed to be a country of laws.

'Nuff said.

Jerry

Check out my prosperity blog at:

http://MoneyloveBlog.com

Subscribe to:

Comments (Atom)